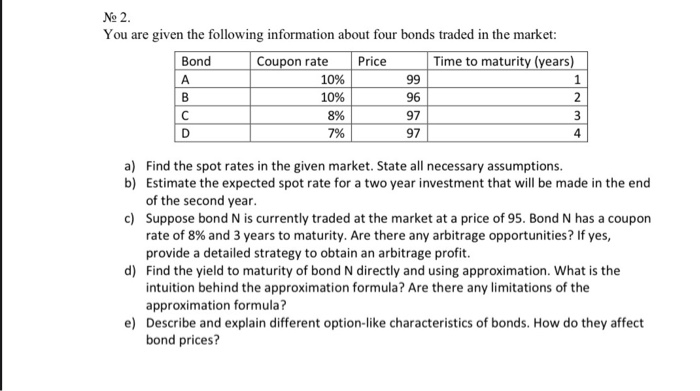

By implementing effective bookkeeping practices, construction companies can gain better control over their budgets and ensure projects contribute positively to their How Construction Bookkeeping Services Can Streamline Your Projects bottom line. For contractors managing several projects simultaneously, tracking costs and ensuring profitability for each one can be overwhelming. Overlaps in labor, equipment, and material usage further complicate bookkeeping. Jonas Premier is a fully featured accounting system for midsize and enterprise-level construction companies.

- Another key benefit of cloud-based solutions is that they provide seamless mobile access for on-site teams.

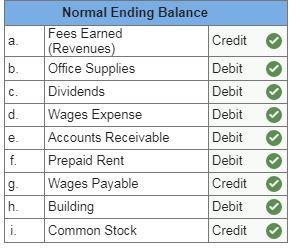

- Proper expense categorization is crucial for accurate job costing and financial reporting.

- Regarding accounting, Foundation provides AIA billing, retainage tracking, and customizable invoices on the accounts receivable side of things.

- To help close the gap, I’m sharing the biggest pitfalls I see contractors run into when it comes to bookkeeping, and how to move past them.

- Once in place, it will not only help you ensure your original estimate was correct but confirm you’ve accurately captured the scope of the project based on what you’ve bid.

- According to JOBPOWER, when you choose the desktop version, you’ll receive unlimited and toll-free telephone support for one year.

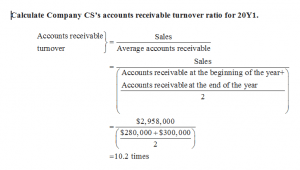

Job costing

This may mean that the contractor can defer taxable income if the contract is not completed by the next tax year. As a result, there are special considerations for tracking, reporting, revenue recognition, collection and cash flow strategies, and cash management in construction. Internal controls are procedures and policies that construction companies put in place to ensure the accuracy and integrity of their financial records. Construction companies should have a system of internal controls in place that includes segregation of duties, regular audits, and oversight by management. To simplify this process, many construction companies use payroll software that can automatically calculate wages and taxes.

Choosing The Right Bookkeeping Software

- Construction accounting is a specialized branch of financial management tailored to the construction industry.

- Look for best accounting software that gives you real-time, big-picture insights with enough detail to work with.

- To ensure compliance, construction companies should consider hiring a tax professional or a bookkeeper who is knowledgeable in tax laws.

- This helps you identify potential issues or delays early on and adjust your plans accordingly before they become bigger problems that could impact the project’s outcome.

- With better quotations and cost control, contractors can protect tight margins and continue undertaking suitable projects.

It requires an understanding of unique accounting principles and regulations specific to the industry. We found PENTA Construction best for midsize to large commercial and industrial contractors. That’s because it delivers a deep feature set to support complex workflows with time and billing management, detailed job costing, and financial reporting.

QuickBooks Enterprise

Often, bookkeeping and accounting become an added stress, leaving you less time to run the business and https://www.merchantcircle.com/blogs/raheemhanan-deltona-fl/2024/12/How-Construction-Bookkeeping-Services-Can-Streamline-Your-Projects/2874359 raising the risk of mistakes with your accounts. These ratings are meant to provide clarity in the decision-making process, but what’s best for your business will depend on its size, growth trajectory and which features you need most. We encourage you to research and compare multiple accounting software products before choosing one. Despite these differences, construction accounting still adheres to general accounting principles and requires accurate record-keeping, financial statements, and tax compliance.

The Internal Revenue Code (IRC) provides guidelines for various depreciation methods, including the Modified Accelerated Cost Recovery System (MACRS), prevalent in the United States. Choosing the appropriate method can influence both short-term and long-term tax strategies. Interest capitalization, as outlined in IAS 23, requires determining borrowing costs directly attributable to the construction project and incorporating them into the asset’s cost.

Start your 30-day free trial of our bookkeeping software today

Our outsourced bookkeeping services are designed specifically for the construction industry. We take care of everything from financial tracking to cash flow management, ensuring your books are accurate and compliant. Construction accounting software will help keep your team organized because it records financial transactions in one centralized location. For example, the software can keep track of project expenses, invoices, cost-plus hours, etc. Depending on the project, many accounting software on the market are specified, and general accounting software may be applicable.

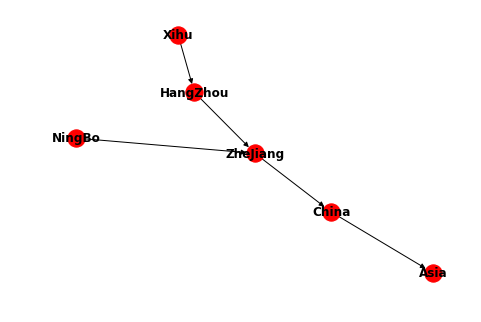

Thus, the fluctuating production input costs and availability need to be planned and tracked differently. Using software and tools can help construction companies streamline their bookkeeping process and improve efficiency. There are many software options available that are specifically designed for construction companies, such as QuickBooks for Contractors, Foundation Software, and Sage 100 Contractor. A cloud-based solution makes it easier to access your financial records because the information is stored on an external server.

- Therefore, a contractor’s general chart of accounts looks different than it is for a manufacturer or a mass retail or hospitality business.

- Success in the construction industry depends on a lot of things—accurate projections, quality work, timely delivery, and a strong professional reputation, to name a few.

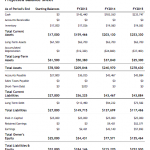

- The balance sheet shows the company’s assets, liabilities, and equity at a specific point in time.

- If you want to be able to plan better, and proactively address problems before they eat into your profit, you need this document.

- WIP reports make it easier to get an overview of each project’s budget, percent complete, actual costs to date, and more, so you can see if it’s overbilled or underbilled.

- Of course, the value of the software will largely depend on the size of the business and how much it grows over time.

By collaborating with them, you can free up your time and resources to focus on growing your business while they manage the financial aspects with precision and accuracy. Additionally, they can provide valuable insights into your business’s financial health and performance, helping you make informed decisions to optimize your operations and maximize your profits. By addressing these challenges proactively, construction companies can streamline their bookkeeping processes and focus more on delivering successful projects. Construction payroll is more complex than in many other industries, as it involves tracking multiple workers, contractors, and varying pay rates. Additionally, compliance with labor laws and union agreements adds another layer of difficulty. For six weeks, you’ll get thorough one-on-one software instruction, which continues with unlimited customer support and group training.